Mortgage Connect’s end-to-end solution supports lenders and servicers through the stages of loss mitigation, specifically for loan modification related activities. Our streamlined process allows for elimination of multiple suppliers and handoffs, improves timelines, and results in dramatic cost savings. Our dynamic platform allows for à la carte services or full end-to-end solutions customized to your processes.

OUR KEY DRIVER – TO IMPROVE PERFORMANCE

Flexibility is a key factor in our partnership, from our technology platform to our operational structure. We customize our process, reporting, and communications to meet your requirements. And, client-dedicated teams with a single point-of-contact model eliminate the need to manage multiple vendors.

- Increase conversion rates, reduce costs, improve time-frames, create seamless consumer experience

- Reduce manual workflow requirements

- Intuitive & user-friendly digital borrower experience

LOAN MODIFICATION TITLE SERVICES

Property Report Services

Title Review & Grading

Loan Modification Insurance

Document Generation Services

Digital Signing Services

Recording Services

Insurance

DEED-IN-LIEU & SHORT SALES TITLE SERVICES

Property Report Services

ALTA Policies

Title Curative Services

Document Preparation Services

Mobile Notary Services

Recordings

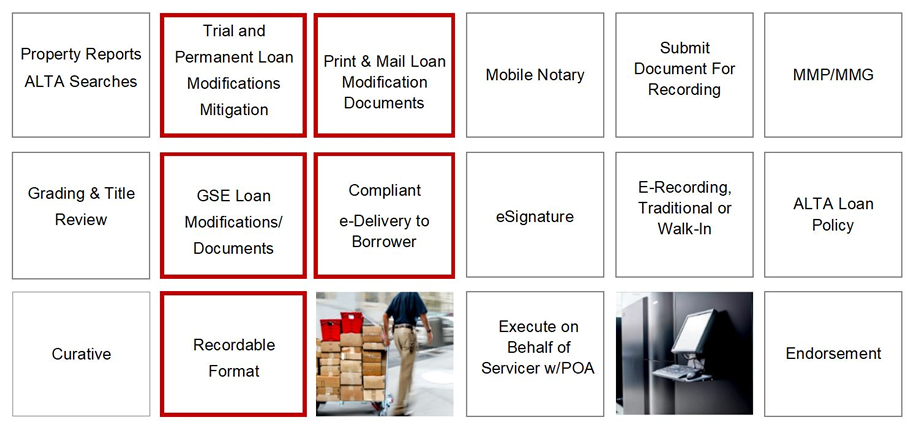

A TRUE END-TO-END SOLUTION FOR LOAN MODIFICATIONS

Mortgage Connect Default Solutions is a national provider of end-to-end solutions across the Default continuum, serving 15 of the top 20 lenders in the country.

We offer a 50-state solution including Valuations, Loan Modifications, Pre-Foreclosure Title & TSG, Deed-in-Lieu & Short Sales and REO Title & Closing services. Across all lines of business we provide an enhanced partner and consumer experience, operational excellence, expertise in regulatory compliance and stringent quality control.